How Salary Sacrifice EV Schemes Cut Electric Car Costs

A practical UAE guide to driving an electric car through employer payroll leasing instead of a large upfront purchase

Electric vehicles offer quiet driving, low running costs, and zero tailpipe emissions. The main obstacle for many drivers is the high upfront price. A salary sacrifice EV scheme changes how you pay for the car. Instead of a large one-time purchase, the cost is spread into predictable monthly payroll deductions through your employer.

For many professionals searching for affordable electric cars across the UAE, this model opens the door to an electric car without the down payment that UAE drivers usually expect when buying outright.

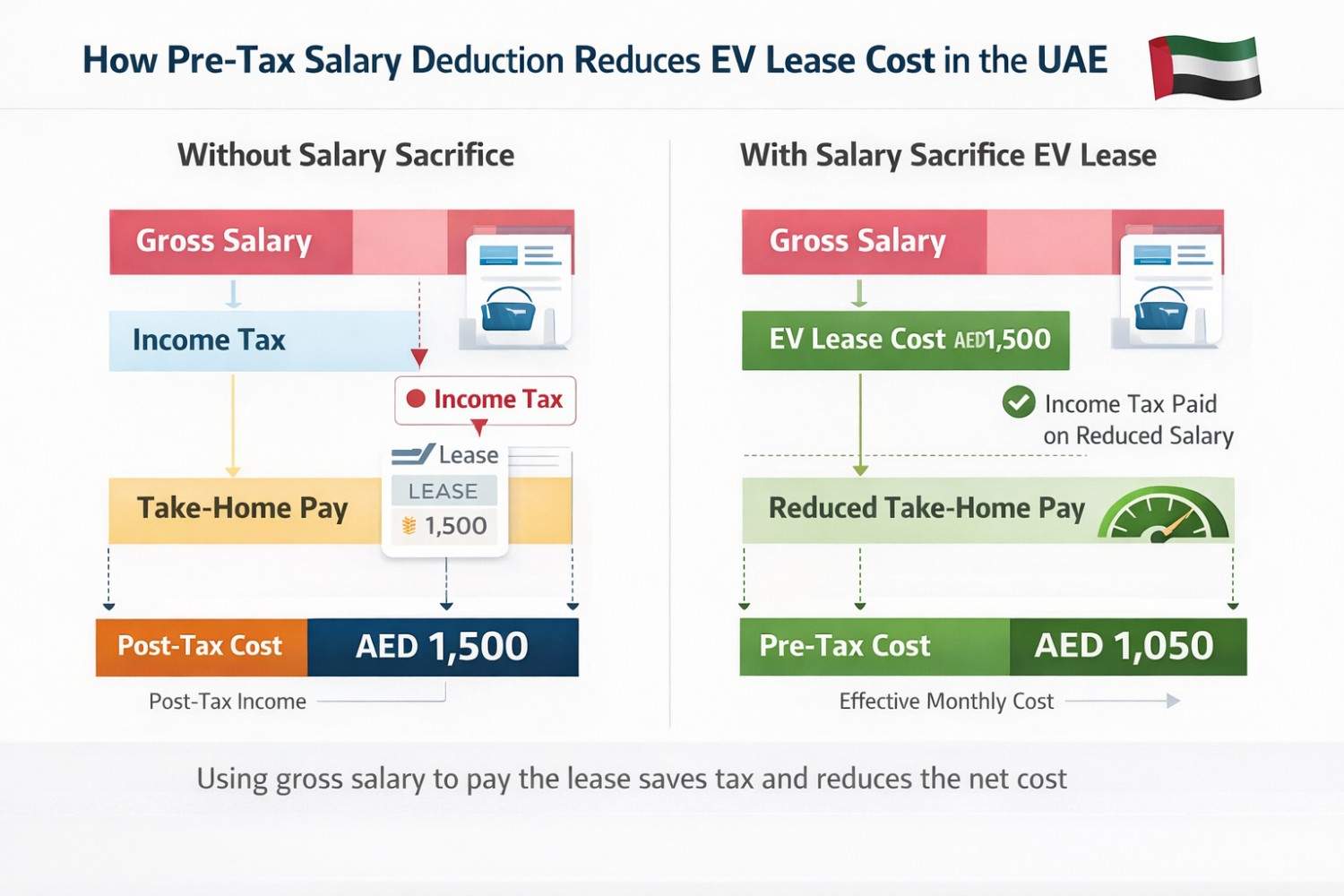

In the UAE, this approach does not create income tax savings, because salaries are not taxed. The real benefit comes from easier cash flow, bundled services, and access to employer-negotiated fleet pricing that can make driving an EV more practical from day one.

What This Blog Covers

-

How salary sacrifice works in simple terms

-

Why EVs are cheaper to run day to day

-

Common mistakes that erase potential savings

-

A quick checklist to decide if it suits your situation

Why Upfront Costs Hold Back EV Adoption

The biggest barrier to going electric is not technology; it is the initial price tag. Many drivers like the idea of an EV but hesitate when they see the upfront cost compared to petrol cars.

Many efficient electric cars still cost more to buy than similar petrol models. Even though charging is cheaper than fuel and maintenance is lighter, the initial payment can be hard to justify.

Common concerns include:

-

Big upfront deposits

-

Long loan commitments

-

Worries about battery life

-

Uncertainty about charging access

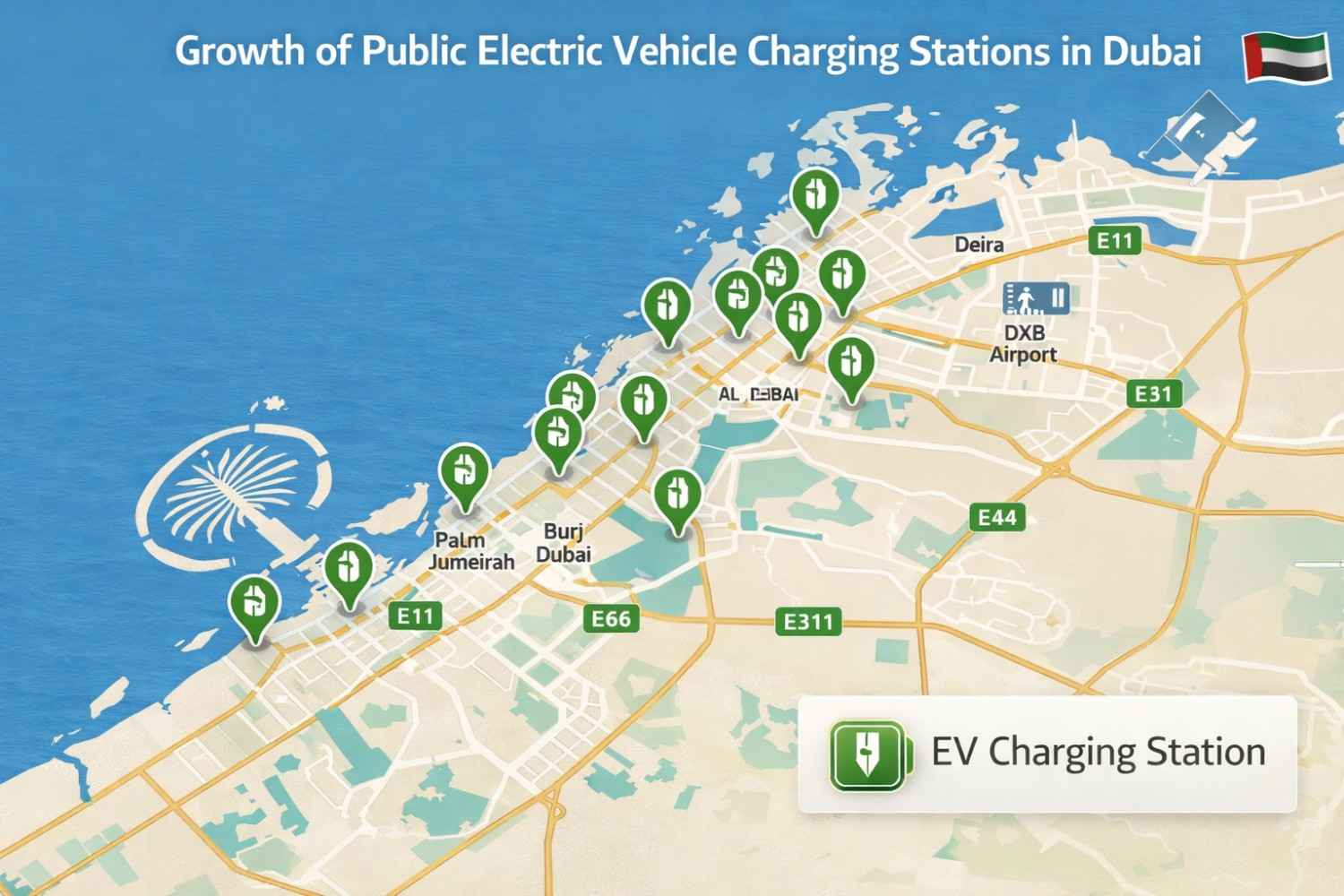

At the same time, guidance from the Roads and Transport Authority (RTA) shows charging infrastructure is expanding quickly across Dubai, supported by a growing network of public EV charging stations that UAE drivers can access daily.

How the Salary Sacrifice EV Scheme Works

This model focuses on how you pay, not what you drive. Think of it as an electric car lease supported by your employer rather than a personal bank loan.

Instead of purchasing a car outright, your employer arranges an employer EV leasing program through UAE EV leasing providers. The monthly cost is handled as a payroll-deductible car lease, taken directly from your salary.

In practice:

-

Your employer signs a lease with a vehicle provider

-

You agree to a fixed monthly deduction

-

You use the car for the agreed lease period

Because the cost is spread over time, you get a zero-upfront-cost electric car instead of paying a large deposit. Many plans include bundled car insurance and maintenance lease, turning several separate bills into one simple payment.

Large organisations can also unlock EV fleet pricing and corporate discounts that individual buyers rarely get on their own.

There is no personal income tax advantage in the UAE. The savings come from convenience, smoother budgeting, and fleet-based rates compared to arranging everything yourself.

Why EVs Save More Over Time

Once the car is on the road, the real financial advantage starts to show. The electric vehicle running cost UAE drivers experience is typically far lower than petrol.

Electric motors are far more efficient than combustion engines. That shows up clearly when you compare EV vs petrol cost per km UAE commuters pay every day.

Benefits include:

-

Lower energy cost per kilometre

-

Fewer moving parts and less mechanical wear

-

No oil changes or exhaust repairs

An EV maintenance cost vs petrol car comparison usually favours electric, because there are simply fewer components to service.

Electric vehicle charging at home for UAE residents can cost a fraction of the cost of a full petrol tank for the same distance, helping reduce monthly commuting fuel expenses.

Public charging access is also growing in residential and commercial areas, supported by authorities such as Dubai Municipality.

Over a three to five-year lease, these everyday savings quietly accumulate.

Common Mistakes That Erase Your Savings

The scheme makes EVs accessible, but poor choices can cancel out the benefits. Smart selection matters more than flashy specifications.

Watch out for:

-

Choosing an oversized or high-performance model with a high lease rate

-

Ignoring excess mileage charges

-

Not confirming reliable charging at home or work

Battery technology is robust, and electric car battery life in hot weather is actively protected by built-in cooling systems, but regular shaded parking still helps long-term health.

A practical, right-sized EV that matches your real driving pattern keeps monthly costs low and savings intact.

How does this affect the UAE Driver?

This is where theory turns into everyday impact. The change is less about luxury and more about smarter monthly spending through an EV monthly payment plan UAE workers can manage easily.

Instead of saving for years to buy an EV, you can start driving one almost immediately with:

-

Lower upfront commitment

-

Clear, fixed monthly costs

-

Reduced fuel and servicing bills

-

Access to the latest safety and technology features

For daily commuters in Abu Dhabi, Sharjah, and Dubai, replacing regular petrol spending with cheaper charging can feel like extra disposable income each month.

Quick Decision Checklist

If most of these points apply, the scheme will likely suit you well.

-

An employer-approved scheme is available

-

Stable monthly income to cover the deduction

-

Reliable charging point nearby

-

Expected mileage fits within the lease limit

-

Comfortable committing for several years

Frequently Asked Questions

Is the car mine at the end of the lease?

Usually no. You return it or start a new lease on a newer model.

Can I leave the scheme if I change jobs?

Exit terms vary. Always check transfer or early termination conditions.

Do EVs work well in UAE heat?

Yes, Modern battery systems are engineered for high temperatures, though shaded or indoor parking improves efficiency and longevity.

Conclusion

A salary sacrifice EV scheme turns electric mobility from a large one-time payment into a manageable monthly commitment. Instead of tying up savings in a single transaction, you get a structured, predictable way to drive electric.

While there is no income tax break in the UAE, the model delivers value through bundled services, fleet pricing, and day-to-day savings that encourage more drivers to switch from petrol to electric driving.

As charging networks expand and technology improves, employer-backed leasing offers a realistic route to electric cars with predictable monthly car costs rather than a large one-time expense.

For more practical guides and updates on electric cars and mobility in the region, read the latest insights on the ArabWheels blog.