Car Loan vs Leasing: What’s Better in the UAE?

Explore the pros and cons of car loans and leasing options in the UAE to make the best decision for your lifestyle and budget.

In the UAE, choosing your next set of wheels isn’t just about which model turns heads; it’s about money, convenience, and lifestyle. When deciding between a car loan vs leasing, should you go for the stability of owning your ride with a car loan, or the flexibility and lower monthly payments of leasing? It’s not always easy, especially with so many factors to consider.

Let’s cut through the jargon and explore what really makes sense in 2025, whether it’s owning a car or leasing it. After all, both options come with their own perks and potential pitfalls, so let’s see which one actually saves you more money and stress in the long run.

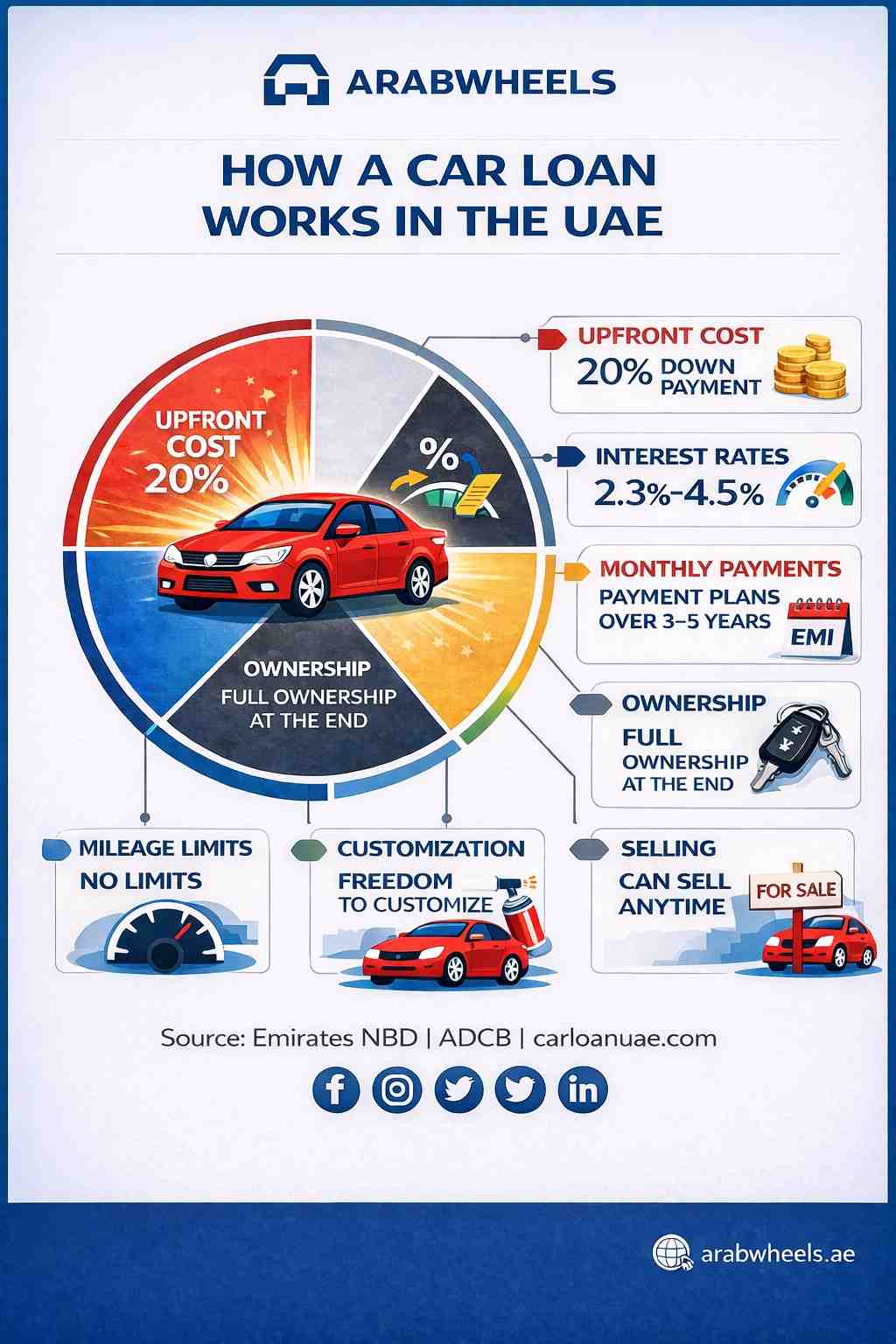

How a Car Loan Works in the UAE

Taking a car loan in the UAE means borrowing money from a bank or finance company to buy the car outright. You pay a down payment (often around 20% of the car’s value), then monthly instalments plus interest over 3–5 years. When the final payment clears, the car is entirely yours.

Interest rates can vary, but flat rates around 2.3–4.5% per annum are common on car loans here, and some lenders may offer even better deals depending on your profile.

Owning a car means no mileage limits, total freedom to customise, and the ability to sell the car whenever you want. A loan can cost more upfront and in monthly payments than leasing, but you’re paying for an asset you’ll keep rather than just use.

Leasing in the UAE: How It Really Works

Leasing is like long-term rental. You choose a car, sign a contract, often for 2–4 years in the UAE, and pay a monthly fee. At the end of the term, the car is returned to the leasing company unless you choose to buy it (if that option is available in your deal).

The big attractions of leasing here are lower monthly payments, smaller or even no significant down payment, and the ability to drive newer models more often. Most leases also bundle maintenance, insurance, and registration into a single predictable payment, which simplifies budgeting.

On the flip side, leases come with mileage limits (often around 20,000–30,000 km per year), and exceeding them triggers penalties. You also won’t build ownership equity, and modifying the car is usually off-limits.

Leasing vs Buying: The Real Cost Debate

Leasing in the UAE almost always feels cheaper each month because you’re only financing depreciation, not the full car value. In a sample comparison of a mid-size SUV, renting (leasing) showed lower monthly costs and bundled services, while loan payments were higher but led to full ownership.

This brings us to the central question in the Car Loan vs Leasing debate: Which option is truly the most cost-effective? Experts also note that if you plan to keep a car beyond about five years, owning, whether purchased outright or financed with a loan, tends to be more cost-effective because you eliminate monthly payments and can even recover some of your investment by selling your car later.

Who Wins in the UAE? It Depends on You

If you’re in the UAE for a short stay (like an employment contract or a couple of years), leasing might actually be the more intelligent choice. Lower upfront and monthly costs, predictable billing, and newer cars every few years make life easier for expats or professionals who don’t want to wrestle with selling a car later.

On the other hand, if you’re a long‑term resident, drive a lot, or hate restrictions, a car loan makes sense. You’ll end up with an asset, no mileage caps, and complete control over the vehicle. If you keep that car for many years after the loan ends, your per‑month cost drops drastically.

Is Leasing Worth It in the UAE?

Yes, for the right lifestyle. Lease plans are especially popular when you want simplicity and a fresh ride every few years without the hassle of selling or maintenance dramas. Insurance, servicing, and paperwork are all wrapped into one monthly fee, which is a huge convenience for many drivers here.

But from a pure financial perspective, leasing doesn’t build equity. You never own anything at the end, so if saving money in the long run and owning an asset matters to you, a car loan is usually a better value over time.

Final Take: Car Loan vs Leasing in the UAE?

There’s no one‑size‑fits‑all answer. Leasing is perfect if you crave low monthly costs, hassle‑free upkeep, and flexibility. Car loans are best if you want an asset, unlimited mileage, and potential long‑term savings. Most UAE expats lean toward leasing for short stays, while long‑term residents who plan to stay for years favour buying.

At the end of the day, your personal goals and driving habits should guide the choice. Weigh your budget, how much you drive, and how long you plan to use the car, and you’ll see which route actually saves you money and stress in the UAE.

Driving smart always starts with choosing the right way to pay for your wheels. Which route are you leaning toward? Share your thoughts in the comments below, and don’t forget to check out more insights, tips, and comparisons on Arabwheels Blog!